23 months ago I was watching Bloomberg TV - on a short list of my favorite channels - when I encountered the fresh perspective of a man named Shaun Rein. Rein, Founder and Managing Director of Shanghi-based China Market Research Group, was brought on the March 2011 show to field questions about bearish outlooks on China from several Western thought leaders including famed hedge fund investor Jim Chanos.

Having spent over 3 months in China the previous year, during which I met extensively with business owners, real estate developers, and government officials, I felt fairly informed about China’s economic development. While visiting cities such as Shenzhen, Dongguan, Guangzhou, Beijing and Tianjin, I couldn’t help but believe the real estate sector was overheated in a manner that, if not properly addressed, would comprise China’s socioeconomic stability and continued economic growth trajectory. A jungle of cranes and skyscrapers as far as the eye can see (which admittedly, in many cities blanketed by a thick and ominous fog, is not necessarily too far), and vacant, speculatively held properties exceeding $3,000 per sq. meter were enough red flags to catch my attention.

But Rein made a compelling case as to why China, facing 10-20% wage and commodity inflation, and guided by prudent economic stewardship, was not threatened by a looming collapse of its real estate market. I wasn’t yet convinced, but I was listening. (Video: Bloomberg TV)

A few weeks later, while surfing the web, I stumbled upon a CNBC article titled “Why Best Buy Failed In China”, written by who other than Shaun Rein. This guy was popping up all over the place, and for good reason, his uncommon insider’s perspective was, arguably, more thoughtful than any other expert on China.

Over the next few months, and a few articles later, I reached out to Shaun to thank him for his research-driven insights on the China market, and pick his brain about related topics. Shaun was gracious, responsive and genuinely interested in helping out fellow entrepreneurs entrenched in the international trade space.

In November 2011, Shaun reached out personally to inform me of the forthcoming release of his highly acclaimed book; The End of Cheap China: Economic and Cultural Trends that Will Disrupt the World. Pleased to receive this news, I quickly secured my preorder on Amazon.

In the Spring of 2012 I had the opportunity to meet Shaun at a Midtown Manhattan book signing and networking event. The venue was packed with successful China-focused intellectuals and businessmen from America, China, Korea, Russia and Africa, among other places. Equipped with a seemingly endless supply of anecdotes and market facts, Shaun captivated his audience, especially those less familiar with his enlightened thoughts. Sidetracked by the responsibilities of growing HD Trade Services, I was not able to write a review, until now.

Chapter 1: Chinese Billionaires Outnumber American Ones

Much to the contrary of conventional Western thought, Chinese businessmen are savvy and sophisticated. The most successful businesses in China are focused on building great brands, not copying Western intellectual property and business models. Further, Having experienced the depths of despair firsthand, economic momentum has created a palpable optimism looking into the future.

Top Chinese companies have already successfully navigated treacherous domestic competition, the gradual process of brand recognition, and rising input costs, making them fit to compete on a global scale. For this reason, Rein cautions Western executives to beware of aggressive, fast moving, well capitalized Chinese companies which pose an underestimated competitive threat to established brands.

Not only has the day arrived when many Chinese firms offer products that are as good as Western goods, but many compete head to head on quality and innovation.

Aided by rising nationalism, Chinese consumers will commonly select domestic brands of products believed to be of equal quality, even if they are more expensive. Domestic dairy company Mengniu - whose amazing Beijing plant I visited in January 2010 - prices its offerings at a premium to foreign brands as a way to establish the perception of superior quality among consumers. This is especially important in the dairy industry given rampant cases of tainted milk.

Rein asserts that Baidu, for example, accused of being a clone of Google, is actually a higher performing search engine for Chinese text, optimized to the preferences and nuances of the Chinese internet user. It doesn’t hurt, of course, that the Chinese government has greater confidence in domestic owned technology firms to responsively censor according to party mandates.

In the 1990s, fewer than 10% of Western brands were profitable in China. Many became discouraged by consumers they thought would never value brands. This naive outlook did not consider that Chinese consumers in the 1990s had wholly different aspirations and needs than Western consumers. Today, as per capita income has quadrupled, over 80% of Western brands are profitable in China. Those that have patiently positioned their branding according to the evolving aspirations of Chinese consumers, have been rewarded handsomely. And it’s only the beginning.

Chapter 2: Cheap Chinese Labor? Not Anymore.

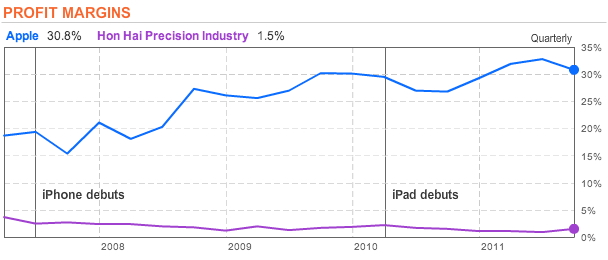

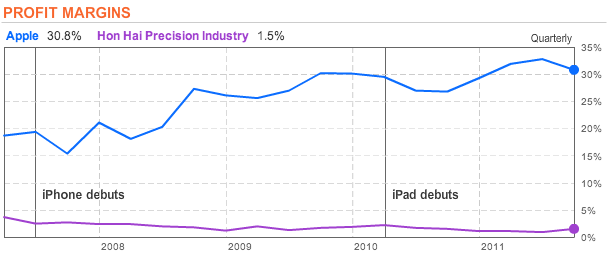

The resultant of diminishing labor supply is a marked increase in manufacturing wages. In many manufacturing provinces we’ve seen year-over-year increases in excess of 20% for the past three years. This causal relationship is known as the Lewisian turning point.

Rising labor rates and the appreciation of the renminbi (Chinese currency) have made Chinese exports less appealing. Rein contends that factory owners engaged in export must shift their attention to the Chinese domestic market where consumer industries are experiencing double digit growth.

Finally, Rein points out that higher paying jobs are the key to avoiding widening income gaps, the classic downfall of emerging economies such as Mexico.

Chapter 3: Stability Is The Key To Happiness

While the Chinese haven’t forgotten about the tremendous pain and suffering of the Cultural Revolution, a stable society and consistently improving quality of life brought about by economic reform has certainly contributed to generational happiness and contentment with the Chinese Government.

The focus of the Chinese Government is on maintaining this consistently improving quality of life for all of its people. To achieve this, the central government is investing heavily in welfare programs and infrastructure development, and combatting corruption within local government. The central government is concerned about controlling and reducing episodes of social unrest. Given complexities of globalization and advancements in technology, this is easier said than done. Free speech - although valued - that threatens stability is therefore not accepted.

On the topic of free speech, Rein reminds us that the Chinese are not afraid to speak out against corruption in public and on internet forums. Over the past several years, censorship of leading international websites for news and social content has actually diminished noticeably.

Somewhat unrelated; Rein shares an interesting reminder that older Chinese are less receptive to brands and have not participated as equitably in the nations newfound wealth. Therefore, their Children are often responsible for purchase decisions. When selling products for use by older Chinese people, your best bet is to market to their 30-40 year old children.

Chapter 4: The Modern Chinese Woman

Much has been reported about China’s one child per family policy which resulted in a disproportionate ratio of males to females. Not long ago, the strength of males was needed, on farms and construction projects, to support their families. Today, in many socioeconomic respects, women have achieved parity with men. Women now account for more than half of income, and there are more women in universities than men. In many families, women are the main breadwinners, while their husbands are commonly vacating unskilled factory positions to care for children.

Understanding women’s role in Chinese society is critical to the success of Western brands. Take, for example, the fact that women account for 55% of spending in the now $15.6 Billion luxury goods market. Women born from the mid 80s to date are raised as “princesses,” pampered and told that the sky is the limit. As a result, many women are becoming entrepreneurs; according to Forbes, 7 of the world’s 14 self-made women billionaires are Chinese. Women are spending freely, even on credit, with the expectation that wages and opportunities for substantial wealth creation are certain to grow. This is a potentially dangerous mindset can lead to a credit bubble.

When marketing to young women, understand that, because many were and are still pampered by their families, they are less mature. For this reason, they are more likely to purchase things that are “cute” - think Hello Kitty - than “sexy.”

Snoopy-branded clothing is one of the hottest selling brands for twenty-something Chinese women…Barbie, by contrast, shut its $37 million store two years after opening.

When marketing fashion apparel, use a mix of Western and Asian models. Western models convey brand prestige, while Asian models show how styles look on similar body types.

Chapter 5: Why Chinese Consider Kentucky Fried Chicken Healthful

Most Chinese, especially food and medical industry professionals, have lost faith in the safety of Chinese food. Oddly, many Chinese consider KFC to be a healthy option. You would think so too after seeing countless reports of local restaurants using reclaimed oil from sewers to cook food! The Chinese trust Western restaurants would never cut corners, and so they are willing to spend a premium to ensure their food is untainted.

The stories in this chapter are horrifying and captivating.

Chapter 6: Understanding Corruption In China

There are three levels of government; central, provincial, and municipal. Provincial and municipal government are riddled with corruption. This has been a source of civic unrest. The central government often executes corrupt officials to set an example, but Rein suggests the problem is more deeply rooted in the divergent interests of local governments, and the nature of single party government.

When doing business in China, make sure you get approval from local and central governments.

Chapter 7: China’s Real Estate Sector

Many Chinese do not trust the accounting of publicly traded companies, so we see a disproportionate amount of wealth being invested in real estate. To avoid speculative investing and control the residential real estate market, which has more than tripled in the past decade, provincial governments have set limits on the number of properties the wealthy can purchase and implemented mandates for up to 50% down payment.

In order to support its growing economy, China needs to continue to invest in infrastructure projects such as low income housing, bridges, tunnels, subway, high-speed rail, and airports.

Chapter 8: Chinese Neo-Colonialism In Africa And The End of American Hegemony

China holds about $3.3 trillion in US foreign exchange reserves. To avoid over-exposure to an instable US Dollar, and ensure access to natural resources critical to the country’s uninhibited economic growth, China has invested significantly in assets around the world. Countries receiving Chinese foreign investment include Canada, Australia, Iraq, Afghanistan, Sudan and several other African nations. China, irrespective of political and religious allegiances, is looking out for its economic interests.

On this note, China does not concern itself imperialistically with the political affairs of the countries in which it invests. Rein uses the term Soft Power to describe the Chinese approach to spreading its growing influence. Notwithstanding this concept, China is consistently criticized by Western governments at odds China’s economic partners such as Venezuela and Iran.

At the corporate level, Rein encourages us to embrace Chinese acquisitions of Western companies as opportunities to deliver high returns to stakeholders, and grow employment. Unlike Japanese firms, Chinese companies typically keep Western management in place and often invest to achieve faster growth, resulting in much-needed American job creation.

The average Chinese tourist spend $7,000 dollars per trip to the US. As China’s 350 million person middle class begins to travel, Western nations must invest in conveniences (such as accepting China UnionPay bank cards) to enhance the experience for these tourists and optimize profits.

Chapter 9: China’s Educational Sector

Arguably, the biggest problem faced by multinational companies operating in China is recruiting and retaining labor. Rein attributes this to a weak talent pool bred by an education system that overemphasizes rote memory, lacks world class curricula, career path flexibility, and infrastructure to support annual graduating classes of more than 6 million. What’s more, only 30% of high school graduates continue to college, compared with 70% in the US.

The vast majority of China’s wealthiest families are obtaining foreign passports as a means to send their children abroad for schooling.

As China matures, the education system will remain under great pressure to reform. The long term stability of China rests largely on major improvements in this sector.

Chapter 10: What The End Of Cheap China Means For The Rest Of The World

Rein equates China to a teenage superpower.

…displaying glimpses of future genius, but unable to maintain a consistent level of power.” This characterization is fitting, as China’s rapid ascent during a period in which much of the developed economies remain stagnant, has placed the country in a position tremendous power and responsibility.

Global stability is key to economic growth. While the US continues to serve as the world’s police, it is likely that China will continue to focus on improving the welfare of its people through major investments in infrastructure and education. The globalization of commerce, and interdependency of nations provides a compelling support for global stability.

Conclusion

The End Of Cheap China is a wonderfully insightful portrait of where China has been, the state of current affairs (and the underlying reasons), what the future holds, and how to position your company to ride the transformative wave that is China’s burgeoning economy. Driven by primary market insights and well over a decade of personal exposure to China’s economic and social ascent, and institutions; Shaun Rein provides a well organized, riveting, and informed account on China along with priceless actionable insights for business and government.

The one thing missing from this book is the role eCommerce will play on the proliferation of Chinese domestic consumption and international trade. We will follow up with our view on eCommerce - domestic and international, B2B and B2C - and the central role we believe it will play on the continued economic growth of China and international companies that implement a culturally sensitive winning strategy.

I hope the Chinese Government does not censor our website for sharing Shaun Reins insights!

INSIGHTS at a glance:

- 27 - the age of the average home buyer (32 in America)

- 7 of the world’s 14 self-made women billionaires are Chinese

- More than 50% of income is earned by women

- $7.8 Trillion GDP

- 1.344 Billion people

- 350 million middle class consumers

- Women like cute not sexy

- When marketing clothing, use a mix of Western and Asian models

- Guanxi (circle of trust) is overemphasized by Westerners

- The average Chinese tourist spend $7,000 dollars per trip to the US