Look around your house, look around your office. What percentage of products - furniture, fashion and accessories, electronics, housewares, appliances - do you think were made in China? Based on market data, chances are that number is close to 50%.

Now name one Chinese brand. Commence awkward silence. Do we hear crickets chirping?

Using Survata, a web-based market research service, we asked 1,500 Americans the following question; “Name the Chinese brands with which you are most familiar (list up to 5 brands).” The results were startling. 94% of Americans surveyed could not name one Chinese brand.

The 5 most frequently listed Chinese brands:

|

Brand / Company |

% of Respondents |

Category |

|

Lenovo |

2.53% |

Consumer Electronics |

|

Baidu |

1.20% |

Internet, Search |

|

Huawei |

1.07% |

Telecom & Consumer Electronics |

|

Haier |

0.87% |

Home Appliances |

|

Air China |

0.87% |

Airlines |

The Ultimate Paradox

China is the world’s second largest economy and nearly 50% of all durable consumer goods purchased in the United States are made in China. How can it be that only 6% of Americans can name one Chinese brand?

Anyone who attended the 2013 Consumer Electronic Show knows that Chinese brands are trying to break out in the US. Hisense, ZTE, Huawei, Chonghong, K-Touch, and TCL were all present, however, many of these firms committed the 4 Fatal Mistakes of Trade Show Marketing.

Why is Chinese brand awareness so low among American consumers?

Besides the stereotypical ignorance which Americans are often (unfairly in this case) accused of, there are some very good reasons for such poor Chinese brand recognition.

Focus on China. It’s early in the development of Chinese brands. We understand this. Many Chinese companies are focused on establishing their brands – and perfecting their offerings – in the Chinese market, and therefore have not dedicated the resources necessary to enter the United States Market. The Chinese economy is growing significantly faster than the US economy, fueled by 4 times the number of addressable consumers. Brands that solidify their place in the Chinese domestic market stand to reap enormous rewards moving forward.

Buy vs. Build. Well-capitalized Chinese firms that have entered the US and international markets frequently elect to acquire Western companies with a pre-existing footprint - market share and brand recognition – rather than pursue organic growth which is seen as slow and uncertain. For Chinese management that may not have a firm grasp of the nuances of American consumer preference and effective market development strategy, pursuing growth through acquisition is a logical and commendable choice. This method became gained further appeal when the 2008 global economic crisis presented many acquisition targets at wonderful valuations.

Well-known acquisitions include Lenovo’s takeover of IBM’s PC business in 2005, and Geely’s acquisition of Volvo from Ford in 2010.

Poor US Market Development Strategy and Execution. When entering the US market there are many nuances that Chinese companies need to consider. These nuances range from consumer preference and expectations (design, functionality and pricing), communication, and identification of relevant sales channels. Of the surprisingly low number of companies that enter the US market we see a common theme of poor strategy and execution that does not properly consider the aforementioned nuances.

Why should Chinese companies develop brands and enter the US market?

According to the United States Bureau of Economic Analysis, consumer spending on durable goods is expected to reach $1.26 Trillion in 2013, while per capita disposable income is $38,000. This alone is reason enough to seriously consider US market entrance.

A more ominous reason looms. The costs of doing business in China are rising, and putting enormous pressure on manufacturers to remain profitable. Labor wages and real estate are rising at 15-20% year-over-year. Commodity prices have inflated substantially since the global economic crisis, and - due to strong growth in demand from emerging markets - it doesn’t look like there will be a material reversal of this trend.

Since contract manufacturers provide a commoditized service, brand owners frequently migrate production to the lowest price bidder. Mega contract manufacturers like Hon Hai Precision Industry (Foxconn) are able to achieve economies of scale and invest in highly efficient production equipment, further increasing competitive challenges.

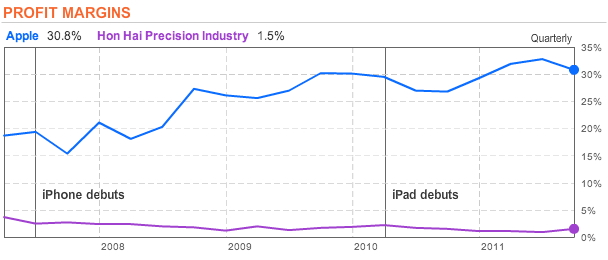

Brands make a disproportionate amount of the profit. Consumers pay a premium for brands. A case study is the relationship between Apple and Hon Hai Precision Industry. Hon Hai Precision Industry provides contract manufacturing services for Apple and other major electronics brands. Each of these companies are leaders in their respective industries. From 2007 to 2012, Foxconn’s profit margin has been in steady decline ranging from 3.7% to 0.9%. During this same timeframe, Apple’s profit margin has strengthened from 18.7% to 32.8% (25.35% as of year end 2012).

In our recent INSIGHTS article, Brand or Die, we make the case that OEM is like a dangerous drug that the Chinese economy is addicted to, which will have deadly consequences for unbranded contract manufacturers.

At HDTS, we see a more strategic reason to enter the US market. That is, to gain US consumer validation which will ultimately assist with your domestic (China) market development. By introducing your product and brand to the US market and establishing a close feedback dialogue with your early adopters, you will gain valuable feedback that will help enhance your product offering. International success and an improved product offering will amplify your credibility and appeal among target consumers in China. We call this the multiplicative effect of US-Sino market development.

Chinese Brands To Look Out For

So which are the Chinese consumer product brands to take note of? Here’s our list of major Chinese brands that you can expect to see a lot more of moving forward. Many will become household names.

|

Company / Brand |

Category |

URL |

|

ASD |

Cookware |

|

|

Belle International |

Footwear |

|

|

BYD |

Electric Vehicles, Lighting, Energy Storage |

|

|

Flyco |

Personal Care & Home Appliances |

|

|

Haier |

Home Appliances, Consumer Electronics |

|

|

Hisense |

Consumer Electronics |

|

|

Huawei |

Telecom, Consumer Electronics |

|

|

Konka |

Consumer Electronics, Home Appliances |

|

|

Lenovo |

Consumer Electronics |

|

|

Li Ning |

Apparel |

|

|

Meizu |

Consumer Electronics |

|

|

Little Swan |

Home Appliances |

|

|

Midea |

Home Appliances |

|

|

Septwolves |

Apparel |

|

|

Skyworth |

Consumer Electronics |

|

|

TCL |

Consumer Electronics |

|

|

Tsingtao |

Beer |

|

|

XDREAM |

Consumer Electronics |

|

|

Xiaomi |

Consumer Electronics |

|

|

ZTE |

Telecom, Consumer Electronics |

Survey results, at a glance:

-

1,403 of 1,500 respondents (94%) were unable to name a Chinese brand.

-

9 of 1,500 respondents (0.6%) were able to name 5 Chinese brands.

-

10% of men can identify at least one Chinese brand vs 4% of women.

-

Awareness of Chinese brands increases monotonically with age bracket: 4.7% for 13-17 year, 4.9% for 18-22 years, 5.4% for 23-29 years, 6.0% for 30-39 years, 11.5% for 40+ years.

-

The most frequently listed Chinese brands were: Lenovo (38 respondents), Baidu (18), Huawei (16), Haier (13), and Air China (13).

-

63% of respondents that could name one brand named Lenovo.

-

4% of respondents named a Chinese consumer brand, 0.8% can named 2, .07% can name 5

-

Among the brands frequently listed by respondents asked to name Chinese brands were a number of Japanese, Korean, and American companies: Toyota (28 respondents, Japan); Sony (22, Japan); Honda (19, Japan); Samsung (18, Korea); and Nike (14, USA).

As a control, we asked 500 Americans to “Name the Japanese brands with which you are most familiar (list up to 5 brands).”

-

293 of 500 respondents (59%) were unable to name a Japanese brand.

-

37 of 500 respondents (7%) were able to name 5 Japanese brands.

- Gender: 60% female, 40% male

- Age: 17% 13-17yrs, 24% 18-22yrs, 20% 23-29yrs, 14% 30-30yrs, 25% 40+ yrs

- 48.5% of men can identify at least one Japanese brand vs 36.8% of women

About this survey

This survey was commissioned by HDTS and conducted by Survata, a web-based market research service. Responses were normalized by a Survata analyst to standardize spellings and semantics. Brands were mapped to the country of the corporate headquarters using Wikipedia and the brand's website. Survey participants were 55% female and 45% male. The age distribution was 15% 13-17 years, 26% 18-22 years, 20% 23-29 years, 15% 30-39 years, 24% 40+ years.

About HDTS

When it comes to durable goods, the consumer has many choices. Positioning your brand effectively is the key to brand recognition and long term value creation. At HD Trade Services (HDTS), we believe in the power of brands and the role eCommerce will play in their proliferation. We combine local market expertise and distribution technology to empower leading consumer product companies to profitably and quickly gain brand recognition and market share in foreign markets by targeting relevant consumers and sales channels. Our core focus is helping industry leading Chinese brands with United States market development.