Chinese manufacturers face a frightening reality; develop a brand strategy, or die.

At HDTS, we work with many Chinese consumer products suppliers who are entirely focused on unbranded services. Frankly, this scares us. As thought leaders, we feel an immense responsibility to speak up - loudly - and let Chinese OEM and ODM contract manufacturers know that, if they do not quickly begin implementing a brand strategy, they will not survive.

In this report we will explain why this situation holds true and how Chinese suppliers can take action to ensure their success and longevity.

Rising input costs.

The costs of doing business in China are rising, and putting enormous pressure on manufacturers to remain profitable. Labor wages and real estate are rising at 15-20% year-over-year. Commodity prices have inflated substantially since the global economic crisis, and - due to strong growth in demand from emerging markets - it doesn’t look like there will be a material reversal of this trend.

Changing US consumer behavior.

Although consumer confidence in the United States is slowly rising, the engine that once powered strong demand for goods manufactured in China is sputtering. Rising living costs, stagnant wages, continued high unemployment, and job insecurity have changed the spending habits of US consumers who are now more cost conscious. Add in downward pricing pressures from eCommerce giants like Amazon.com, and it makes sense that retail price inflation for most goods has not kept pace with the underlying rise in manufacturing costs.

This means there is less margin or profit available for manufacturers, retailers and brands. But who loses?

When margins contract, contract manufacturers lose, every time.

Since OEM and ODM manufacturers provide a commoditized service, brand owners frequently migrate production to the lowest price bidder. Mega contract manufacturers like Hon Hai Precision Industry (Foxconn) are able to achieve economies of scale and invest in highly efficient production equipment, further increasing competitive challenges.

Understanding the value chain.

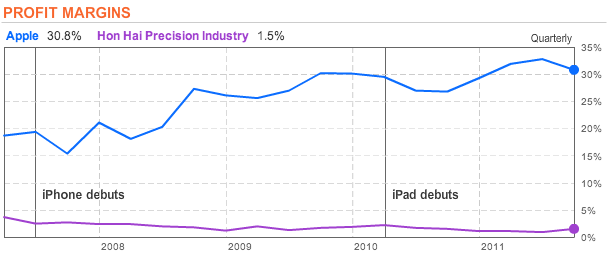

Brands make a disproportionate amount of the profit. Consumers pay a premium for brands. A case study is the relationship between Apple and Hon Hai Precision Industry. Hon Hai Precision Industry provides contract manufacturing services for Apple and other major electronics brands. Each of these companies are leaders in their respective industries. From 2007 to 2012, Foxconn’s profit margin has been in steady decline ranging from 3.7% to 0.9%. During this same timeframe, Apple’s profit margin has strengthened from 18.7% to 32.8% (25.35% as of year end 2012).

We understand that Apple’s uncommon success and massive scale has allowed it to negotiate very favorable contracts with Foxconn. This notion simply demonstrates that contract manufacturers are at the mercy of the brand holder.

The value is where the customer experience is, downstream.

Apple is a prime example of just how important it is to be involved with downstream business. Apple’s supply chain extends to retail, which allows it to capture substantially greater value than electronics hardware companies that rely on resellers which include wholesale distributors and retailers. Controlling retail also means Apple can control the end customer’s experience. It’s hard to think of many other companies that control the end customer’s experience better than Apple. Creating an excellent customer experience is what builds repeat customers who quickly become advocates for your brand. We will discuss the importance of customer experience more in later publications.

Why not build a brand?

There are many reasons why contract manufacturers will avoid marketing products under their own brand. First and foremost, launching a brand as a contract manufacturer conflicts with the interests of OEM clients. One way to mitigate this conflict of interest is to start by launching a brand and product line that’s focused on a different product category and therefore does not infringe on the client’s intellectual property in terms of design, engineering and brand identity. Another way to mitigate this conflict of interest is to register a separate company and appoint separate management. If you begin competing directly with your client, the proper thing to do would be to notify your client of the potential conflict of interest and encourage open communication to resolve the conflict with professionalism and courtesy.

At HDTS, ethical business practice is a foremost priority. So as long as you are taking the necessary precautions; we encourage you to not let potential conflict of interest discourage you from doing what is best for your company, employees, and shareholders.

Another reason why contract manufacturers choose not to brand is because they perceive branding to be expensive, distracting, and outside of their core competencies. This used to be a valid set of concerns, but not anymore. The rise of technology combined with the right local market expertise has dramatically reduced the cost - in both money and time - of brand development, while dramatically increasing the probability of success for new brands.

HDTS is pioneering this brand development renaissance and we are proud to offer select Chinese suppliers access to our multi-channel distribution platform. For more information, visit our website.

No one ever said it would be easy.

It’s not easy to build a brand. Even with the aforementioned advancements in brand development technology and strategy, the success of a brand still rests on the supplier’s underlying capability, culture, passion, creativity and ability to dedicate its people to the mission and plan for successful brand development.

Brand or die.